Why is my Current Balance different from my Available Balance?

When logging in to your Old Glory Bank accounts, you may see two balances reported for an account: Current and Available. These numbers may sometimes be the same, but when they are not, this can understandably be confusing.

The difference between the Current and Available Balance is quite simple. The Current Balance is the amount in your account while transactions are still pending, while the Available Balance accounts for (subtracting or adding) pending transactions to let you know what is available to spend. Think of the Available Balance as a safety net to protect you from overdrawing your account. If you spend only the funds available in your Available Balance, you significantly reduce your risk of overdrawing your account because of pending transactions you had forgotten about.

Let’s look at a simulated account to understand better how your Current and Available balances may fluctuate during any given week.

- When Tom checked his account on Thursday evening, his Freedom Checking account had a Current Balance of $500.

- On Friday afternoon, Tom’s employer direct-deposited his $1,000 weekly paycheck.

- If Tom has made no other transactions during the day, his Current and Available balances would match, with both reported as $1,500.

- However, Tom paid his $400 car insurance and $150 cell phone bill on Friday, which are pending. Therefore, his Current Balance would be $1,500, and his Available Balance would be $950 because of the $550 in pending transactions.

- Once the pending transactions clear, if Tom has made no other transactions, his Current and Available balances would be $950.

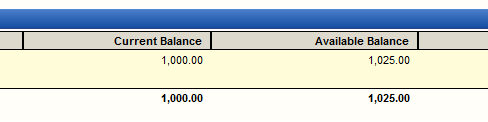

Though less common, you may encounter times when your Available Balance is larger than your Current Balance. This would most commonly be explained by a pending refund or deposit to your account.

Note: Customers who have opted-in and authorized Old Glory Bank to pay overdrafts on everyday debit card transactions will be automatically granted a no-fee Overdraft Security limit of $25.00 after the account has been open for at least 60 days and the account remains in good standing*. For accounts over 150 days in good standing, customers may now request up to $250.00 overdraft protection which would also be calculated in the Available Balance.

It is also important to remember that Old Glory Bank is only able to calculate your Available Balance based on transactions we know about. If you have written a check that has not yet been presented to us for payment, or if you have a recurring payment established for a utility bill or streaming service that has not yet been processed by the vendor, those transactions will not be calculated in your Available Balance.

Old Glory Bank encourages you to regularly check your account balances and transactions to protect against fraud and stay up-to-date on your accounts. Always contact us immediately about any unrecognized transactions at 888-446-5345.

*Good standing is when the account is not currently overdrawn, has no active legal actions such as garnishment, levy, administrative or other legal processes.