Setting and Achieving Financial Freedom is Simple with Old Glory Bank’s GOALS Feature

Whether saving for a vacation or safeguarding against a rainy day, Old Glory Bank offers its GOALS feature to ensure you are prepared for anything.

Old Glory Bank’s GOALS feature is a simple way to make steady progress toward any or multiple financial goals. When you set up a Goal, your savings toward that Goal will be transferred to a GOALS account when you choose – you may set up automatic recurring payments or you may make manual transfers toward your goal whenever you wish. The money you save in your GOALS will earn interest at the same rate that currently applies in our Freedom Savings accounts. Just like your Freedom Checking and Freedom Savings accounts, your GOALS savings are FDIC-insured.

*You must maintain a minimum daily balance of $25.00 in each GOAL to obtain the disclosed annual percentage yield.

When you reach your Goal, you may transfer your money back to your Freedom Checking or Savings account to enjoy the reward of your effort. Need the money sooner? You are free to close your Goal and move the money back to your Checking or Savings account whenever you wish, with no penalty or fee.

Note: Goals are only visible to the account holder who establishes them. In the case of joint account holders, only the person creating the Goal will be able to see the Goal and amount saved, make transfers, and close the Goal.

To set up GOALS on the mobile app:

- Once you log in and your Home screen appears, you will see GOALS in a white box near the top of your screen. (Note: If you utilize Budget & Planning Tools, GOALS will appear just below the Budget & Planning Tools box.)

- Old Glory Bank has identified popular savings goals, such as “Save for an emergency” and “Take off on vacation.” You may choose one of these suggested goals or create custom goals of your own. To choose a suggested goal, click the “Start Saving” button under the goal you wish to work toward. To customize your goal, click “Start Saving” under the + icon.

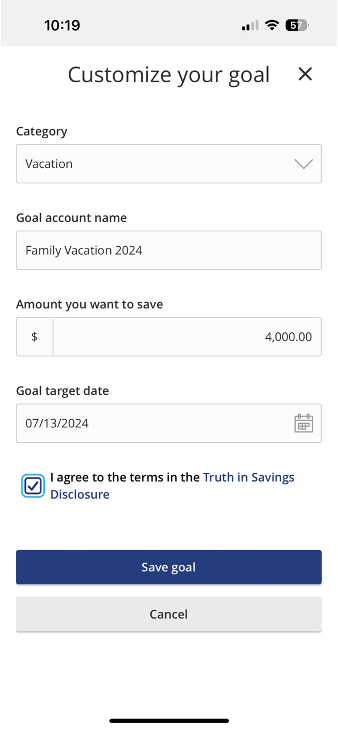

- Next, you will customize your savings goal by confirming or entering the following information:

- Category: Choose from the dropdown menu what you will be saving for. For example, Automobile, Charity, Education, Home Purchase, etc.

- Goal account name: Select a name that clearly identifies your goal. For example, you could name your goal Beach Vacation, Susan’s New Car, Christmas Gifts, or John’s College Tuition, etc.

- Next, enter the Amount you want to save.

- Select your Goal target date.

- Click the Truth in Savings Disclosure to read it thoroughly and then click Accept, or check the box to agree to the terms.

- Finally, click Save Goal.

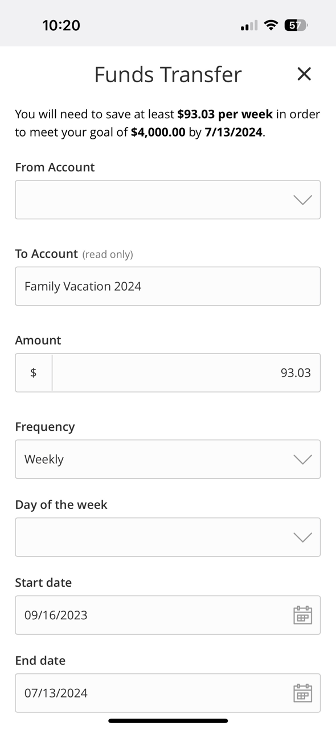

- The next screen will confirm your goal and identify how much you need to save weekly, bi-weekly, or monthly to reach your target.

Note: If your target date is less than 30 days away, the system will suggest a daily savings amount. You may use this information to decide if you want to set a recurring amount to save weekly or if you prefer to save in manual increments on your own schedule.

- Select your Frequency from the dropdown and click Continue to set up your recurring or one-time transfer.

- Complete the required information on the Funds Transfer page to begin achieving your savings goals!

- First, select the Account you would like funds transferred from.

- Next, enter the Amount you would like transferred. (Note: This information was populated automatically based on what you selected on the previous screen, but you may alter that according to your preferences.)

- Select the Frequency at which you would like transfers made. You may also choose which Day of the week you prefer transfers.

- Finally, enter your desired Start date and End date. (Note: The start date defaults to the next day on the calendar, and the end date is populated based on your selection on the previous screen. You may customize both.)

- Click Submit transfer.

- Once the confirmation screen appears, you may Make Another Transfer or Close if you have completed setting up your goals.

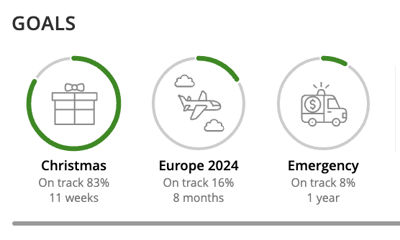

- In the future, when you log in to your account, you will see the progress you are making toward achieving your financial goals under the Goals section on your Home screen.

- If at any point you need to alter or close your goals:

- Click on the goal you wish to edit.

- Select the Details & Settings tab.

- Click the pencil icon to edit information, or scroll to the bottom on your screen to Transfer and close goal.

- If closing, select the reason from the dropdown and click Continue.

- Choose the account you would like the funds transferred to and click Close goal.

- Your funds will be transferred to the account of your choosing within one business day, and often within minutes.

To set up GOALS on your desktop:

- Once you log in and your Home screen appears, you will see GOALS in a white box on the right of the screen. (Note: If you utilize Budget & Planning Tools, GOALS will appear just below the Budget & Planning Tools box.)

- Old Glory Bank has identified two popular savings goals: “Save for an emergency” and “Take off on vacation.” If either matches your objectives, please click the “Start Saving” button under the target goal you wish to work toward. To customize your goal, click “Start Saving” under the +.

- Next, you will customize your savings goal by confirming or entering the following information:

- Category: Choose from the dropdown menu what you will be saving for. For example, Automobile, Charity, Education, Home Purchase, etc.

- Goal account name: Select a name that clearly identifies your goal. For example, Susan’s New Car, Lake House, John’s Tuition, etc.

- Next, enter the Amount you want to save.

- Select your Goal target date.

- Click the Truth in Savings Disclosure to read it thoroughly and then click Accept, or check the box to agree to the terms.

- Finally, click Save goal.

- The next screen will confirm your goal and identify how much you need to save weekly, bi-weekly, or monthly to reach your target.

- Select your Frequency from the dropdown and click Continue to set up your recurring or one-time transfer.

- Complete the required information on the Funds Transfer page to begin achieving your savings goals!

- First, select the Account you would like funds transferred from.

- Next, enter the Amount you would like transferred. (Note: This information was populated automatically based on what you selected on the previous screen, but you may alter that according to your preferences.

- Select the Frequency at which you would like transfers made. You may also choose which Day of the week you prefer transfers.

- Finally, enter your desired Start date and End date. (Note: The start date defaults to the next day on the calendar, and the end date is populated based on your selection on the previous screen. You may customize both.)

- Click Submit transfer.

- Once the confirmation screen appears, you may Make another transfer or Close if you have

- In the future, when you log in to your account, you will see the progress you are making toward achieving your financial goals under the Goals section on your Home screen.

- If at any point you need to alter or close your goals:

- Click on the goal you wish to edit.

- Select the Details & Settings tab.

- Click the pencil icon to edit information, or scroll to the bottom on your screen to Transfer and close goal.

- If closing, select the reason from the dropdown and click Continue.

- Choose the account you would like the funds transferred to and click Close goal.

- Your funds will be transferred to the account of your choosing within one business day, and often within minutes.