Old Glory Bank Prosperity 12-Month CD

Exclusively for customers of Old Glory Bank, we bring you the Old Glory Bank Prosperity 12-Month CD!

If you have an existing Old Glory Bank account, including our Freedom Checking account, Freedom Savings account, Premium Checking account, or Liberty Business account, you can transfer funds from your existing account to fund your CD Account.

You may open your CD account online from your online banking portal, or call our customer service team at 888-446-5345 to open it.

To open a CD account online:

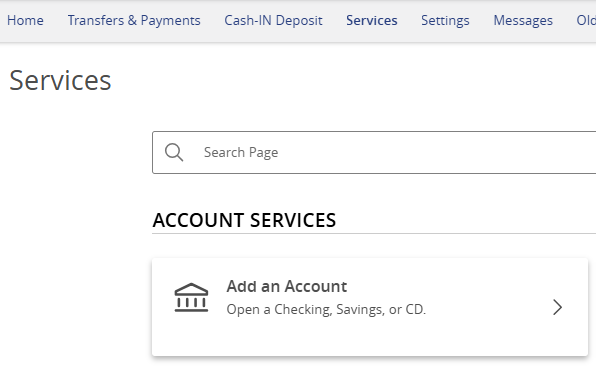

Navigate to the Services menu - Account services - Add an Account

- Choose the Prosperity 12-Month CD option from the drop-down menu:

Note: You must fund the CD when the account is created. If you are not prepared to fund the CD now, please return to your home screen and come back to open the CD when you are ready to fund.

- Visit our website at oldglorybank.com/cd to review the details and terms of the account, including Annual Percentage Yields (APYs). The APY will remain the same for your term of the CD, and interest begins to accrue on the date the account is funded. Your CD Account term will begin when your CD is funded and will mature on the first anniversary (1 year) from that initial funding date.

- You must fund your CD Account by transferring funds from your existing Freedom Checking, Freedom Savings, Premium Checking Account, and/or Liberty Business account subject to the minimum and maximum amounts allowed. The minimum amount to open a CD is $2,500.00. The maximum amount is limited to $250,000.00 per depositor. For example, if there are two customers on a joint CD account, the maximum amount for a CD Account is $500,000.00.

- Statements: CD Accounts do not have statements, but you can view the details, including balance, in our online banking portal and the Old Glory Bank app.

To Close Your CD account:

You may close your CD for any reason without penalty during the first 10 calendar days from its initial funding.

After the first 10 calendar days from initial funding, you may close your CD without penalty:

- Upon maturity.

- During the grace periods, which are either 10 days from initial funding or within 10 days of renewal (at maturity).

*You may close your CD for any reason during the first 10 calendar days from its initial funding. However, if you choose to close your CD Account before maturity, early withdrawal penalties may apply.

To Withdraw Your Funds:

Call our customer service representatives at 888-446-5345 and request an account-to-account transfer or a check mailed to you at your address of record with the Bank. You cannot use a check or a debit card or send an ACH or Wire to obtain permitted withdrawals from a CD Account.

Note: Unless you have provided us instructions for withdrawal or transfer, on the maturity date, your CD will automatically renew to a CD Account of an equal term (1 year) at the current APY for our CD Accounts, as shown on www.oldglorybank.com/cd at that time. You will have a grace period of 10 calendar days beginning on the maturity date to add or withdraw funds without being charged an early withdrawal penalty. We will provide a pre-renewal reminder along with the new interest rate and APY in the renewal confirmation that we send you.

Fees and penalties:

- No Maintenance Fee: There is no monthly maintenance fee for a CD.

- Early Withdrawal Penalty: If you make an early withdrawal before maturity, you will pay an early withdrawal penalty equal to 90 days of interest on the amount of your withdrawal request. The penalty is calculated using the interest rate applicable to your CD Account.

- Exception: We will waive an early withdrawal penalty for the following reasons:

- Any account owner on such a CD Account dies.

- Any account owner on such CD Account is judicially declared legally incompetent.